As Valentine’s Day draws near, the air fills with love, presenting an ideal opportunity for couples to not only strengthen their emotional bonds but also solidify their financial partnership. This blog delves into seven essential budgeting strategies for couples, aimed at enhancing both your relationship and financial health. So, why not make this season of love special by sitting down with your partner over a cup of coffee to transform budgeting from a potential source of stress into a pillar of your relationship’s strength and unity?

Why Budgeting for Couples is Important

Before we jump into couples budgeting tips, let’s discuss the importance of collaborative budgeting for couples. When you both take the time to discuss and plan your finances, it can lighten up any money-related worries and ensure a smooth financial situation. Budgeting as a couple can help you in many ways as mentioned below:

- Promotes open communication: By careful planning of the budget, there is an opportunity for open and honest discussions about spending habits and any potential financial challenges. It’s a great chance to tackle any hidden debts or careless spending habits.

- Sharing responsibilities: Sharing financial responsibilities with your partner can help reduce stress.

- Helps with goal setting: Whether you’re dreaming up the perfect summer escape or taking on ambitious financial goals, joint budgeting as a couple allows for the establishment of both short-term and long-term goals.

- Boosts spending management: Joint budgeting offers a holistic perspective on monthly expenses, enabling improved control over financial allocations. This insight allows for the reallocation of funds to more important or meaningful areas.

Now that we’ve covered the important advantages, let’s dive into the 7 essential tips to master budgeting for couples!

Tip 1: Set Financial Goals Together

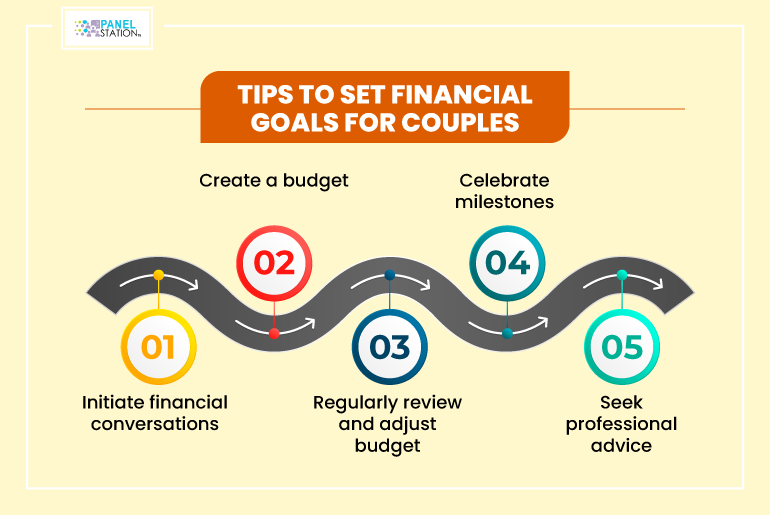

Establishing financial goals as a part of budgeting for couples can bring together the couple’s dreams and create a shared vision for their financial future. By defining clear objectives, you not only enhance your financial stability but also cultivate a deeper understanding of each other’s priorities and values. Moreover, it lays the groundwork for effective future planning, offering a framework for major life decisions such as homeownership, education, or retirement.

Tip 2: Keep Track of Income and Spending

Tip 2: Keep Track of Income and Spending

It is lovely to go on holiday and spend quality time together. In fact, spending time together, away from the hustle and bustle of life helps in strengthening a relationship. But for a peaceful holiday retreat, it is also important for you to start planning your budget with your partner to keep a detailed record of your income and expenses. Having clear visibility into your finances can really make a difference. By keeping a close eye on your income and expenses, you can gain some really useful insights into your financial habits. So, if you haven’t already, start keeping track of your joint income and expenditure from today. It will also help you plan a better holiday in the future.

![]()

Tip 3: Be Honest With Your Partner

Now, let’s talk about honesty, the glue that holds all this budgeting magic for couples together. Honesty is the foundation for a long-lasting relationship and by being open and honest about personal finances, spending habits and future aspirations you can establish a strong bond of trust and transparency with your partner. You can work together to create a budget that aligns with your shared aspirations by providing an accurate and complete picture of your finances. Being open and transparent about your values and priorities will allow you to have a better understanding of each other and make well-informed decisions about your financial future.

Tip 4: Find Side Hustles

Now let’s discuss a fun aspect of budgeting for couples. Starting a side hustle, like taking paid surveys or freelancing in your spare time, can greatly enhance your ability to handle and accomplish your financial objectives. They offer a great way to boost your income and create an extra financial cushion. Embracing a side hustle as a couple can bring about greater financial stability and foster a sense of teamwork and shared financial responsibility. Additionally, it provides a platform for developing new skills and exploring business opportunities, which could lead to additional sources of income.

Tip 5: Save for Bigger Goals

Let’s talk about the big one – saving as a couple for those life-changing goals. We’re not just talking about dipping into your rainy-day fund. We mean setting aside cash for the big milestones like buying a house, financing your kid’s future rockstar education, or gearing up for the golden years. It’s like planting seeds of financial happiness and watching them grow into a garden of dreams. Joint financial planning to save creates a sense of togetherness and strengthens the shared goals, setting the stage for a more peaceful and relaxed lifestyle.

Tip 6: Create a Joint Account

It might be worth considering the idea of opening a joint bank account as a way to strengthen and enhance your relationship. Pooling your financial resources in a joint account promotes openness, confidence and mutual accountability. It’s a concrete representation of togetherness, where both individuals actively contribute to the financial stability of the partnership. Having a joint bank account can greatly enhance your ability to budget effectively, align your financial goals and plan for a future together. As Valentine’s Day is approaching, use this special occasion to show your dedication not just emotionally, but also financially.

Tip 7: Don’t Forget Your Individual Dreams

When it comes to building a strong and satisfying relationship, it’s important to remember the importance of nurturing personal dreams and aspirations as well. Having shared goals is important, but it’s also crucial to recognize and encourage each other’s dreams to make the relationship more fulfilling. Embracing personal aspirations brings a unique flavor to our collective adventure and empowers each person to flourish on their own. By embracing and supporting each other’s aspirations alongside their joint ones, couples create a foundation for a more joyful and resilient life together.

In Conclusion

Managing finances as a couple isn’t just about crunching numbers; it’s about investing in a happier, more peaceful, and long-lasting life together. So, grab your partner in crime, set those financial goals, spill the tea, embrace the side hustle of life, and watch as your dreams and bank accounts flourish. Here’s to a budgeting adventure that’s as thrilling as your love story! Cheers to a happily ever after filled with financial bliss!

Frequently Asked Questions on Budgeting for Couples

Q: What is the 50 30 20 rule?

The 50-30-20 rule is a widely known budgeting guideline that recommends individuals to divide their income into three categories: needs (essential expenses), wants (discretionary spending), and savings. This framework offers an easy and efficient method for managing finances and prioritizing savings goals.

Q: What is a proportional budget for couples?

When it comes to budgeting for couples, one approach is to divide expenses in a way that reflects each partner’s income proportion. Let’s say one partner earns 60% of the total household income. In that case, they would contribute 60% towards shared expenses. This approach strives to achieve an equitable distribution of financial responsibilities, considering the varying income levels within the relationship.

Q: How do most couples split finances?

Many couples choose to divide their finances by merging certain aspects while keeping others separate. Many people opt for joint accounts to handle shared expenses such as rent, utilities, and groceries, while also keeping individual accounts for personal spending. This approach enables individuals to work together on common financial objectives while also maintaining the freedom to handle their finances.

Q: Should husband and wife share money?

Deciding whether or not to share money is a personal choice that varies from couple to couple. Many couples prefer to handle their finances in different ways. Some decide to merge all their income and expenses, while others take a more mixed approach by having joint accounts for shared expenses and separate accounts for personal spending. Open communication is crucial for success, as it allows couples to align their financial strategies with their shared goals and values.