Make achieving financial stability your resolution for 2024. Read on to learn how to achieve this goal through simple steps. .

Let’s kick off with a heartfelt New Year’s greeting – Wishing you an incredibly joyful new year filled with abundant success and well-deserved achievements. Now is the perfect moment to reflect on your aspirations and plans for the year 2024. There are various reasons why someone might want to make positive changes in their life. Some may strive for better health and fitness, while others may aim to be more active or reduce their reliance on social media. Some may also have career goals they are determined to achieve.

New Year’s resolutions are often made with great excitement, but unfortunately, they tend to lose momentum after the initial burst of motivation. Did you know that a whopping 80% of people fail to keep their new year resolutions by February? While it is unfortunate, there is no need to worry, because we’ve got you covered. Through this blog, we want to help you with a few resolutions including tips for smart spending, retirement planning and wealth management that will help bring some financial stability into your life! So, let’s get started!

Why Financial Stability Matters

Before we go ahead, we want to highlight the importance of financial stability. Whether you’re just starting out in your career or you’re a seasoned professional preparing for retirement, one thing remains constant: the importance of financial stability. Ensuring financial stability will help you overcome unexpected challenges and achieve your long-term dreams. Therefore, it is all the more important for you to be financially prepared for any unexpected surprises that may come your way.

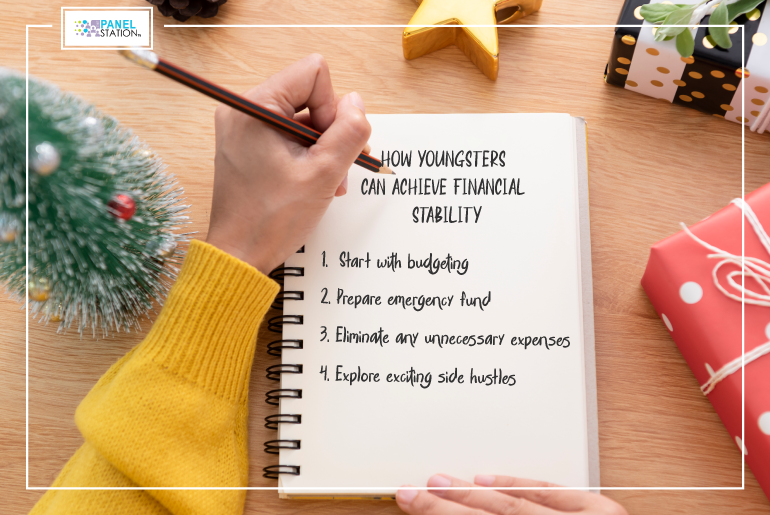

How Youngsters Can Achieve Financial Stability in 2024

Discovering the ropes of personal finance can often feel like a daunting task, especially for young people. However, achieving financial goals is not an impossible task. , In fact, by implementing a handful of easy and effective strategies listed below into your everyday routines, you can make substantial progress in ensuring your financial stability in the long run.

1. Getting Started with Budgeting:

Create a budget that clearly lays out your expenditures. Find unnecessary expenses and set aside some of your earnings for savings. There are some amazing apps out there that can really take your budgeting game to the next level. Mint and YNAB are two popular options that can automate and track your budget, making it a breeze to stay on top of your finances.

2. Emergency Fund:

Planning for unexpected events by establishing an emergency fund is a cornerstone of financial stability in 2024. Set up an emergency fund to tackle those unexpected expenses. It’s important to have a solid financial cushion by saving up to three to six months’ worth of living expenses. Make sure to create a dedicated savings account and consistently put aside a small portion of your pocket money in it.

3. Eliminate Any Unnecessary Expenses:

Here’s a suggestion: Take a closer look at your monthly expenses and see if there are any areas where you can make some adjustments. Chalk out a saving plan. You might want to think about packing your own lunch instead of eating out every day, getting rid of any subscriptions you don’t use or looking into cheaper options. Making small adjustments can have a big impact, allowing you to save money or pay off debt more efficiently.

4. Explore Exciting Side Hustles:

Utilize your talents or interests to earn some extra cash with side gigs. Whether it’s freelancing, selling handmade crafts, or offering tutoring services, a side hustle can significantly increase your overall income. Platforms such as Upwork, Fiverr or Etsy offer convenient ways to showcase your talents. You can also try paid online surveys where you can share your opinion and earn money. It is one of the easiest ways to make some extra money in your free time. To start with you can explore The Panel Station platform.

Do keep in mind that achieving financial goals requires developing positive habits from the start. These strategies provide a practical and attainable way to navigate towards a stable financial future.

Other Ways to Achieve Financial Stability in 2024

If you are a senior looking for financial stability, you don’t need to overcomplicate things. We will tell you about maximizing your earnings with efficiency. You can make your financial future more secure with the below simple and achievable tips.

1. Retirement Planning:

It’s important to have a clear plan for your retirement that guarantees financial security in 2024 and in the future. When you take the time to plan ahead, you are making a smart investment in your peace of mind. This financial strategy can ensure the accumulation of ample resources to face challenges, ensuring a secure and stress-free retirement. It’s more than just a smart financial move; it’s a way to set yourself up for a worry-free retirement, where you can focus on enjoying the good things in life.

2. Be Mindful of Those Debts:

Being mindful of your debts is all about taking a strategic approach to organizing your financial situation and ensuring long-term financial stability in 2024. Instead of feeling overwhelmed by the sheer volume of debts, breaking them down into smaller, more manageable portions can provide a clearer perspective. It’s all about organizing your financial closet. Making extra payments each month is a great way to take control of your finances and simplify your financial situation. This debt management strategy is not just about lightening the financial load, but also about working towards a more stable and prosperous financial future in the years to come.

3. Coupons and Vouchers:

Seize those incredible chances, whether it’s shopping for groceries or embarking on a journey with online coupons and vouchers. There are many ways to get online coupons and vouchers but the easiest way is through paid online surveys where all you need to do is share your opinion, earn points and redeem those points for vouchers from top brands.

4. Safer investment strategies:

You can consider the reliability and stability of government bonds. Government bonds are widely regarded as a safer investment choice, offering a fixed interest rate and the backing of a government guarantee. These bonds provide a predictable income stream and are less susceptible to market fluctuations compared to riskier investment avenues.

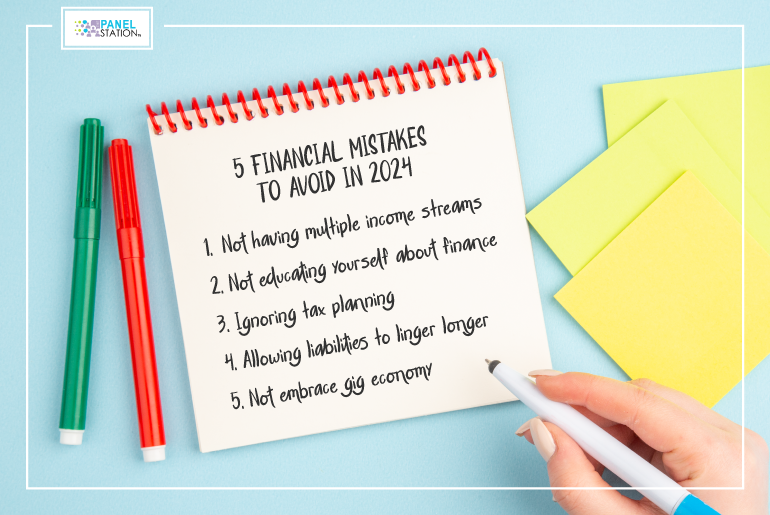

5 Financial Mistakes to Avoid in 2024

# 1: Not Having Multiple Income Streams:

Diversifying your income sources is like creating a financial safety net and is one of the important aspects of achieving financial stability in 2024. Relying solely on a single income stream can leave you vulnerable to unexpected financial shocks. To have multiple income source, you can explore opportunities for side gigs, investments or freelance work. This not only boosts your overall income but also enhances financial resilience.

#2: Not Educating Yourself About Finance:

It’s not just about earning money; it’s about understanding how to make your money work for you. Financial literacy is your passport to making informed and empowered decisions. Take the time to understand the basics of budgeting, investing and managing debt. This will help you to navigate the complex landscape of personal finance with confidence.

#3: Ignoring Tax Planning:

Taxes may not be the most exciting subject, but it’s definitely one that requires your full focus. The importance of not ignoring tax planning is an integral aspect of achieving financial stability in 2024. Tax planning can be your personal financial guide, leading you through the rough landscape of deductions and credits. Don’t overlook it, or you could potentially miss out on valuable chances to reduce your tax liability.

#4: Allowing Liabilities to Linger Longer:

Dealing with your unpaid debts in a timely manner is not only polite, but also a smart decision for your financial health. The longer those liabilities stick around, the more they can turn into obstacles for your finances. Create a step-by-step plan to say goodbye to those annoying debts and set yourself up for a more seamless financial journey.

#5: Not Embrace gig economy:

Not embracing the gig economy can be a hurdle in achieving financial stability in 2024. Venture into some side hustles or hobbies that can help you earn some additional income. It’s not only about the financial aspect, but rather about staying engaged and pursuing a passion.

In Conclusion

As we embark on this new year, let’s commit to resolutions that truly make a difference. Achieving financial stability requires a combination of discipline, education and strategic planning. By adopting these resolutions, you’re not just securing your financial future – you’re empowering yourself to live life on your terms. Here’s to a prosperous and financially stable 2024!