Managing your family’s finances effectively can be a bit challenging, especially if you rely on a single income source at home. This can become even more difficult when you have kids to take care of. To ensure the financial security of your family, it is important to have a solid financial management system in place. Balancing your family and finances can be challenging for homemakers, but mastering smart money management is key to securing your financial future.

As a homemaker, you play an important role in shaping your family’s financial well-being. Your influence extends to budgeting, saving and money management, and you can make a significant impact on your family’s finances.

In this blog, we will explore practical tips and strategies for smart money moves that homemakers can implement. These insights will not only enhance your financial knowledge but also contribute positively to your family’s income. But first, let’s understand the important role homemakers play in family finances.

Understanding the Role of Homemakers in Family Finances

When it comes to running a household, homemakers are not just caregivers; they are financial experts! They take charge of managing family finances with finesse. Homemakers excel at budgeting, excel at saving and are experts at making wise financial choices to make every hard-earned dollar count. They efficiently handle their daily tasks, keeping the finances in mind and running the family smoothly day in and day out. This is crucial for the overall financial well-being of the entire family.

Contributions to the Family Budget

Smart money management for homemakers is all about making wise financial decisions. By being savvy with their money, they can eliminate unnecessary expenses and significantly boost their savings. This approach helps the family make the most of their resources and manage their budget effectively. Moreover, many hardworking individuals, just like you, are actively seeking ways to create additional income sources. They explore opportunities such as freelancing, participating in paid online surveys like The Panel Station, or even venturing into entrepreneurship. These extra income streams can provide a substantial financial boost to your family and serve as a safety net during uncertain times.

Financial Challenges Homemakers May Encounter

However, it is important to acknowledge the financial challenges that homemakers may face on their journey. Career setbacks, employment gaps and a lack of access to financial education resources can be hurdles. Despite these challenges, homemakers show remarkable resilience and adaptability.

In the upcoming sections of this blog, we will share practical tips on smart money management for homemakers. These tips will help you to enhance your financial skills and have a more significant impact on your family’s finances. Whether you are a homemaker looking to improve your family’s financial situation or someone who wants to support and help homemakers, you have come to the right place.

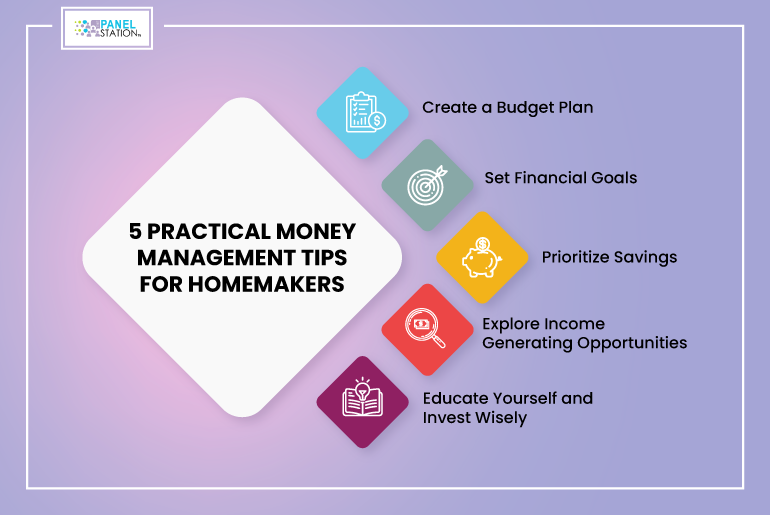

5 Practical Money Management Tips for Homemakers

Juggling family finances, daily spending, and savings can be tough but fulfilling. In this part, we will explore five down-to-earth money management tips designed just for homemakers. These ideas will assist you in making smart financial choices, getting the most from your money and boosting your family’s financial health.

1. Create a Budget Plan

The foundation of mastering your money is a well-strategized budget. It is like a roadmap that shows you exactly where your money is headed. Start by listing down all sources of income. Then, break it down and organize those expenses into two categories: fixed expenses, like your mortgage and utilities and variable expenses, like groceries and entertainment. This will help you track income, control spending, allocate funds to priorities and achieve financial goals. Don’t forget to keep a track of your expenses. To be better organized, you can use budget tracking apps and spreadsheets. This practice will help you identify those areas where you can cut back and allocate more of your hard-earned cash to savings or investments.

2. Set Financial Goals

Take a moment to define those objectives on what you want to achieve in the short-term and the long-term when it comes to your money. Whether it is about saving for a family vacation or planning for retirement or for buying things that makes you happy, having clear-cut goals will help you achieve them faster. Hold on! You don’t have to let all your desires take a back seat in order to achieve your savings goal. We have it covered for you. Know how you can manage your household expenses wisely without compromising on comfort.

3. Prioritize Savings

You might be thinking whether you can stash away enough cash for your little one’s education and still secure a comfortable retirement for yourself. It’s absolutely possible. With some disciplined saving and investing, you can make it happen. You can do this by opening a savings account. Also you can automate transfers to make sure you’re consistent with your savings. Make it a goal to stash away 10-15% of the household income.

4. Explore Income Generating Opportunities

Tips on smart money moves for homemakers is incomplete without the mention of income generating opportunities. There are many homemakers out there who discovered clever ways to contribute to their family’s income through freelancing, part-time work or transforming their hobbies into income-generating ventures. Here is another great way to generate extra income from the comfort of your home – paid online surveys. Yes, you heard it right. With paid online surveys you can earn gift vouchers from top brands and all you have to do is share your honest opinion on products and services through surveys. There are many survey sites where you can register for free and begin your rewarding journey. The Panel Station is one of the leading online survey platforms which you can explore.

Register today and begin your paid surveys journey with The Panel Station.

5. Educate Yourself and Invest Wisely

This is in fact the most important part of effective money management. It is only when you know about savings, investments and policies, will you be able to make informed decisions. Oh no, we are not asking you to pick up a course in finance. You can learn the basics of bonds, mutual funds, insurance etc online. And this knowledge will help you in making smart investments. Remember, it is all about making those calculated moves to secure your financial future.

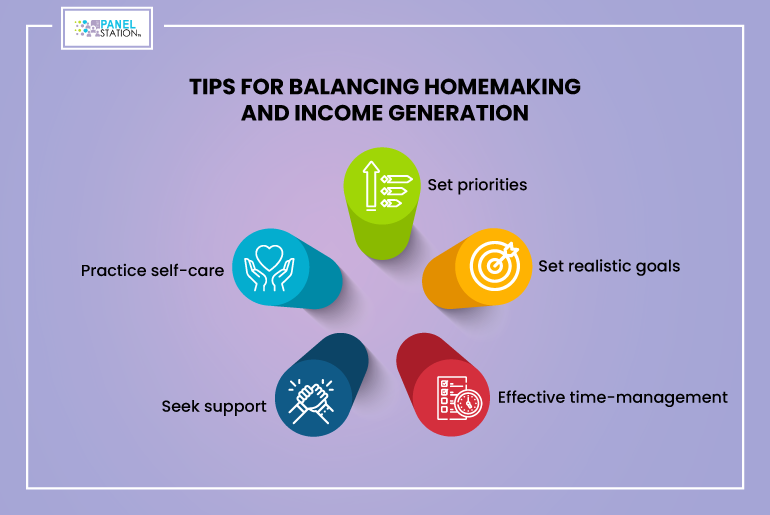

Tips for Balancing Homemaking and Income Generation

Balancing the roles of a homemaker and an income generator can be quite the juggling act. It is not impossible though. With focus, determination and a little bit of hustle, you can find that sweet spot where both your home life and your financial goals are thriving. So, here are some tips for all you homemakers out there who are looking to find that perfect balance between managing your household and bringing in some extra income.

- Set priorities: When it comes to balancing homemaking and income generating, you need to put your time and energy into the things that truly matter. Allocate specific time slots for each one of them.

- Set realistic goals: It is important to understand that one may not have the ability to accomplish everything. In order to attain financial success, it is important to set practical income goals and be flexible in adjusting them as needed. To enhance your productivity and achieve success in your personal and financial pursuits, it is important to exercise caution and avoid taking on too many commitments. By taking this approach, you will be able to protect yourself from the potential dangers of burnout and ensure a harmonious balance in your life.

- Effective time-management: Mastering the art of effective time management is absolutely vital for achieving optimal success and productivity in all areas of life. Divide your day into easily manageable segments, enabling you to effortlessly transition between the responsibilities of maintaining your home and engaging in activities that generate income

- Seek support: Maximize your potential by establishing meaningful connections with fellow homemakers and income generators. Sharing experiences and tips can indeed provide valuable insights and emotional support. Engaging in online communities and forums can prove to be a remarkable avenue for discovering invaluable advice and abundant resources.

- Practice self-care: Always make self-care your top priority. To manage various roles effectively, allocate time for personal rejuvenation and maintain unwavering motivation.

To Sum It Up

In this blog, we have discussed a bunch of practical tips for smart money management aimed at hardworking homemakers. These insights are here to help you strike that perfect balance between managing your household and boosting your income. By following wise money management principles like budgeting, saving and making intelligent investments, you have the potential to significantly improve your family’s financial well-being.

One fantastic option for homemakers looking for a convenient and reliable source of income is taking paid online surveys on platforms like The Panel Station. It offers incredible flexibility, allowing you to earn extra money on your terms.

When you consciously apply these valuable tips and income-generating strategies in your daily life, you are on a path to financial empowerment. You can make a substantial contribution to your family’s financial stability and prosperity while mastering the art of money management.

By incorporating these practices and exploring opportunities like paid online surveys, you can boost your family’s income and secure a brighter financial future.